who is exempt from oregon wbf

Oregon workers are subject to Workers Benefit Fund WBF assessment tax. All wages paid for domestic service described in 316162 Definitions for ORS 316162 to 316221c are exempt from withholding and transit payroll tax.

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

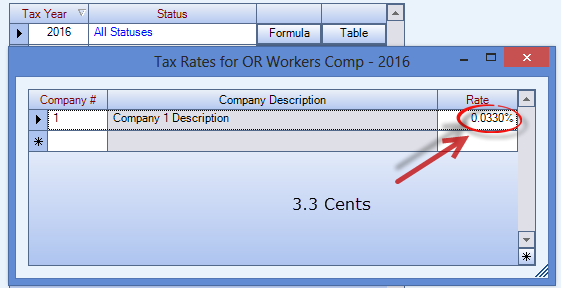

This assessment is calculated based on employees per hour worked.

. Agricultural farm employers who. If you are age 18 or older by December 31 of the taxable year you must file and pay the Arts Tax unless you are exempt. Who Is Exempt From Oregon Statewide Transit Tax.

For 2022 the Oregon workers compensation premium assessment which covers the costs of administering the states workers compensation and worker safety programs is as follows. Tel 541-737-9600 FAX 541-737-8082. 1 2022 this assessment will see no change remaining at 22.

For Oregon Benefit Fund choose Exempt How is. A For the previous tax year the individual had the right to a refund of all Oregon. The DOR is developing a new state.

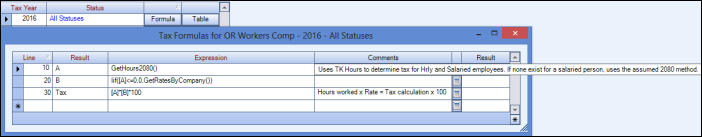

Oregon Workers Benefit Fund The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers owners and. When an employer classifies an employee as exempt from minimum wage and overtime it is up to the employer to establish that the employee meets the criteria for exempt status. Click the other tab and click the or wbf tax.

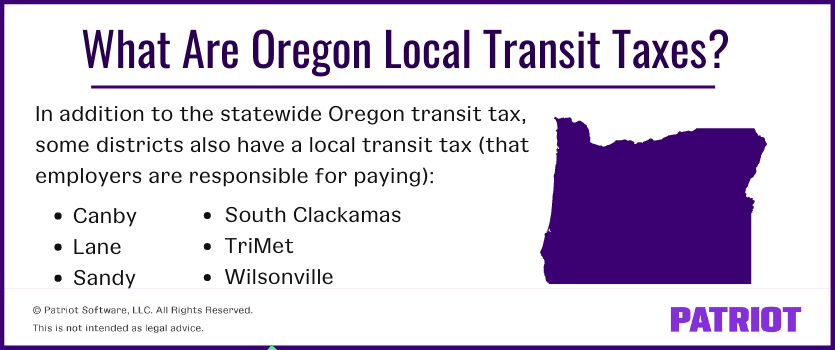

A total of 187 measures appeared on statewide ballots in oregon from 1995 to 2020. Oregon WBF is reported based upon the Employees primary work site and is tied to the State UC code. If the remuneration is not.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. If an employee is an Oregon resident but your business isnt in Oregon you. The WBF is funded by cents-per-hour assessments on both employers and employees.

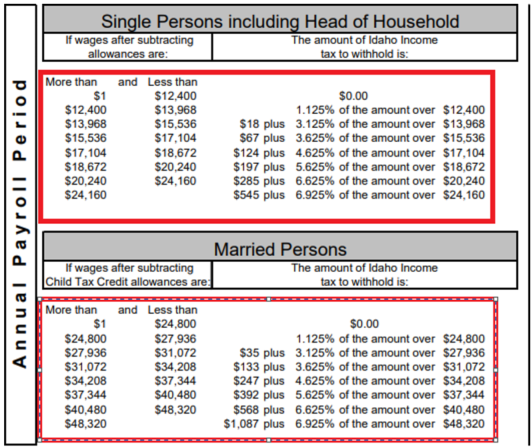

Who is exempt from Oregon income tax. Office of Institutional Research Oregon State university 500 kerr administration Building Corvallis OR 97331-8572. An individual claiming exemption from withholding due to no tax liability must meet the following conditions.

Withhold the state transit tax from Oregon residents and nonresidents who perform services in Oregon. For 2022 the rate is 22 cents per hour. By Eduardo Peters August 15 2022 August 15 2022 All foreign insurance companies those formed under laws from other.

Have 10 or more employees in each of 20 weeks during a calendar year. The two major programs paid from the WBF are the Retroactive Program which pays cost-of-living. When setting up the Tax Information for someone who works primarily in the state of.

Pay 20000 or more cash wages in a calendar quarter or. If your business is not required to carry workers compensation coverage you are exempt from the WBF Assessment. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Benefit Fund Wbf Assessment

Morning Oregonian From Portland Oregon On May 5 1873 Page 3

Oregon Workers Benefit Fund Payroll Tax

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

Oregon Payroll Tax And Registration Guide Peo Guide

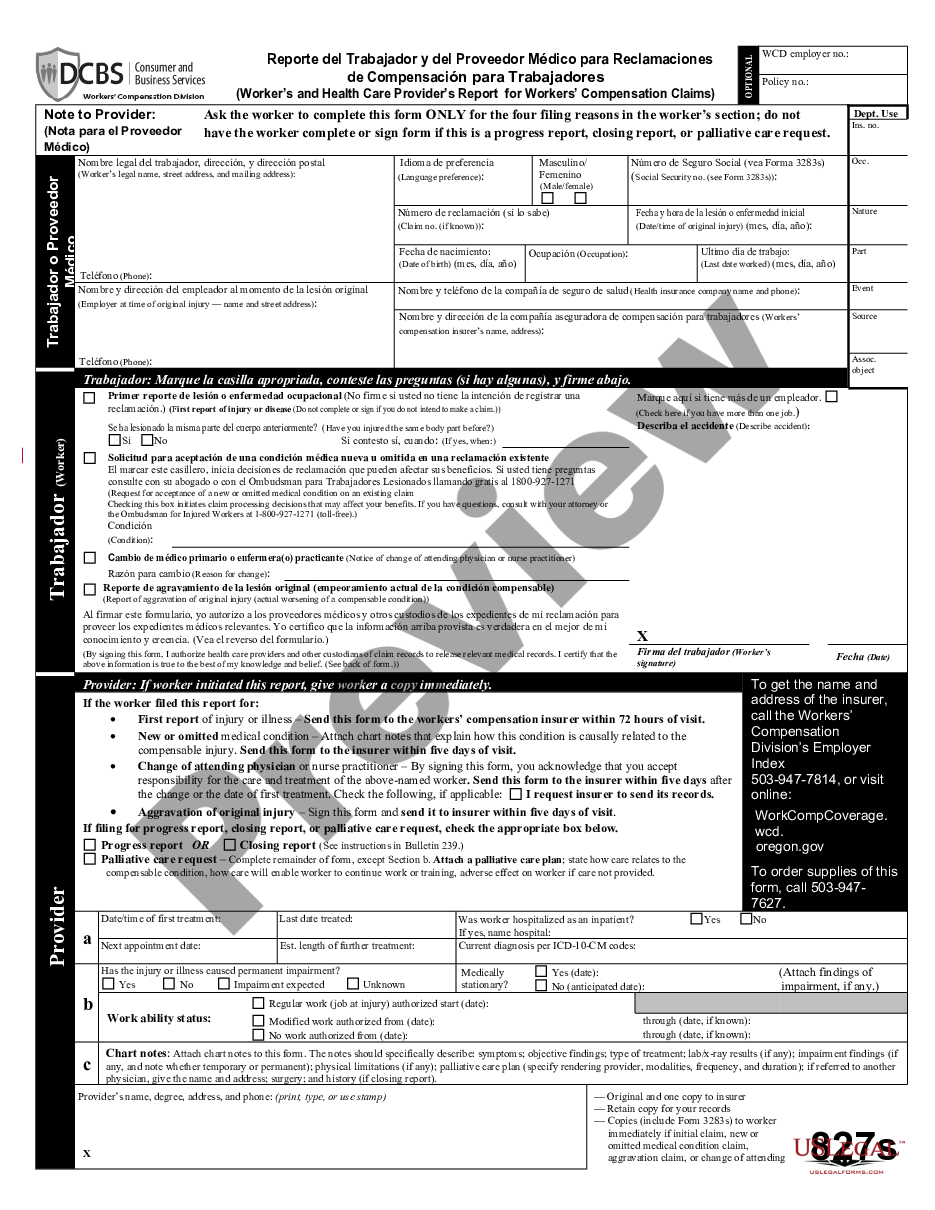

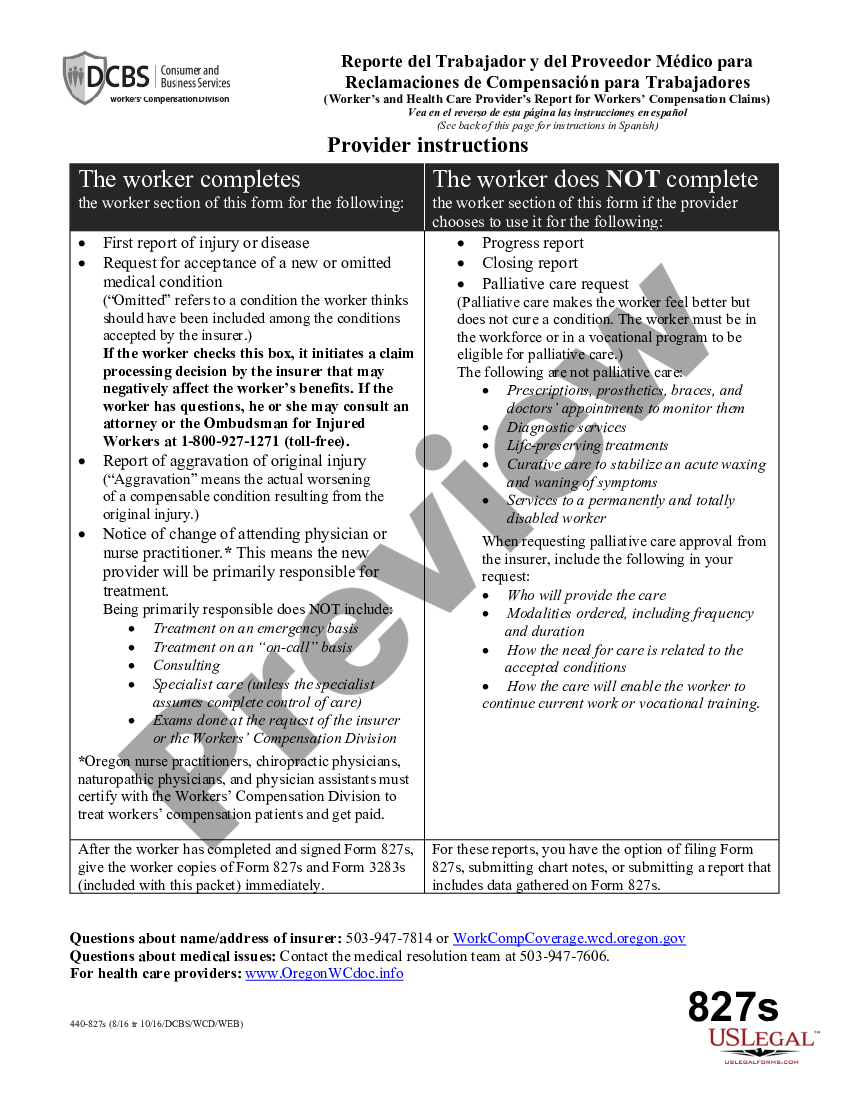

Oregon Workers Compensation Employee Withholding Us Legal Forms

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Workers Compensation Employee Withholding Us Legal Forms

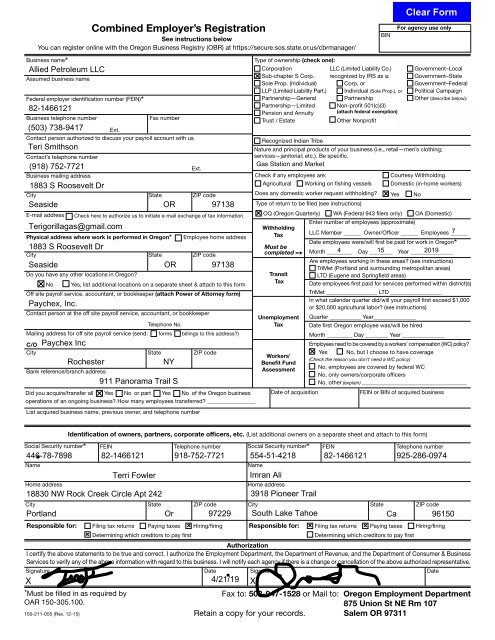

Form 150 211 055 Combined Employer S Registration

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Payroll Tax And Registration Guide Peo Guide

The Complete Guide To Oregon Payroll For Businesses 2022